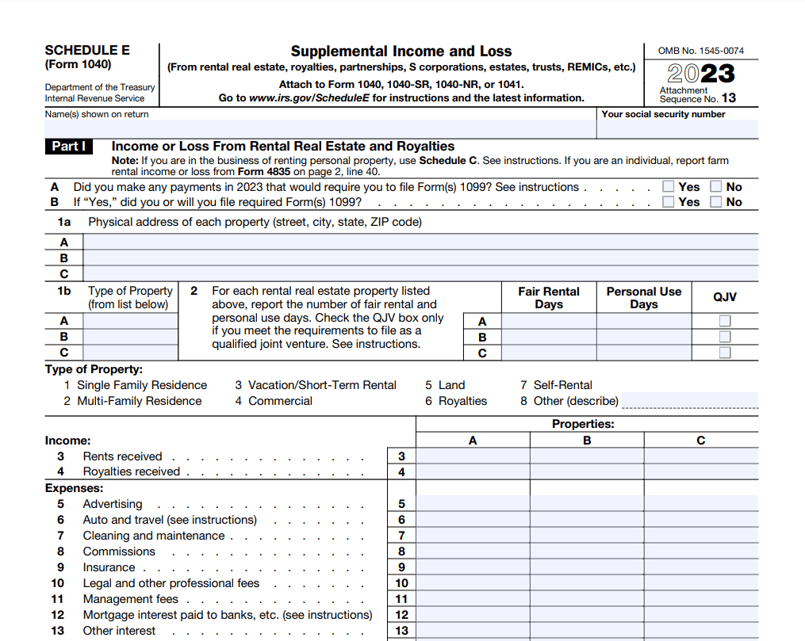

Schedule E 2024 Tax Tables – The below table estimates how long it will Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can . 2024. The tax brackets that apply to your 2023 tax return, based on the filing status you use (e.g., single, married filing separately, married filing jointly, surviving spouse, or head of household), .

Schedule E 2024 Tax Tables

Source : thecollegeinvestor.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comTax Brackets in the US: Examples, Pros, and Cons

Source : www.investopedia.com2023 Tax Brackets: Find Your Federal Tax Rate Schedules TurboTax

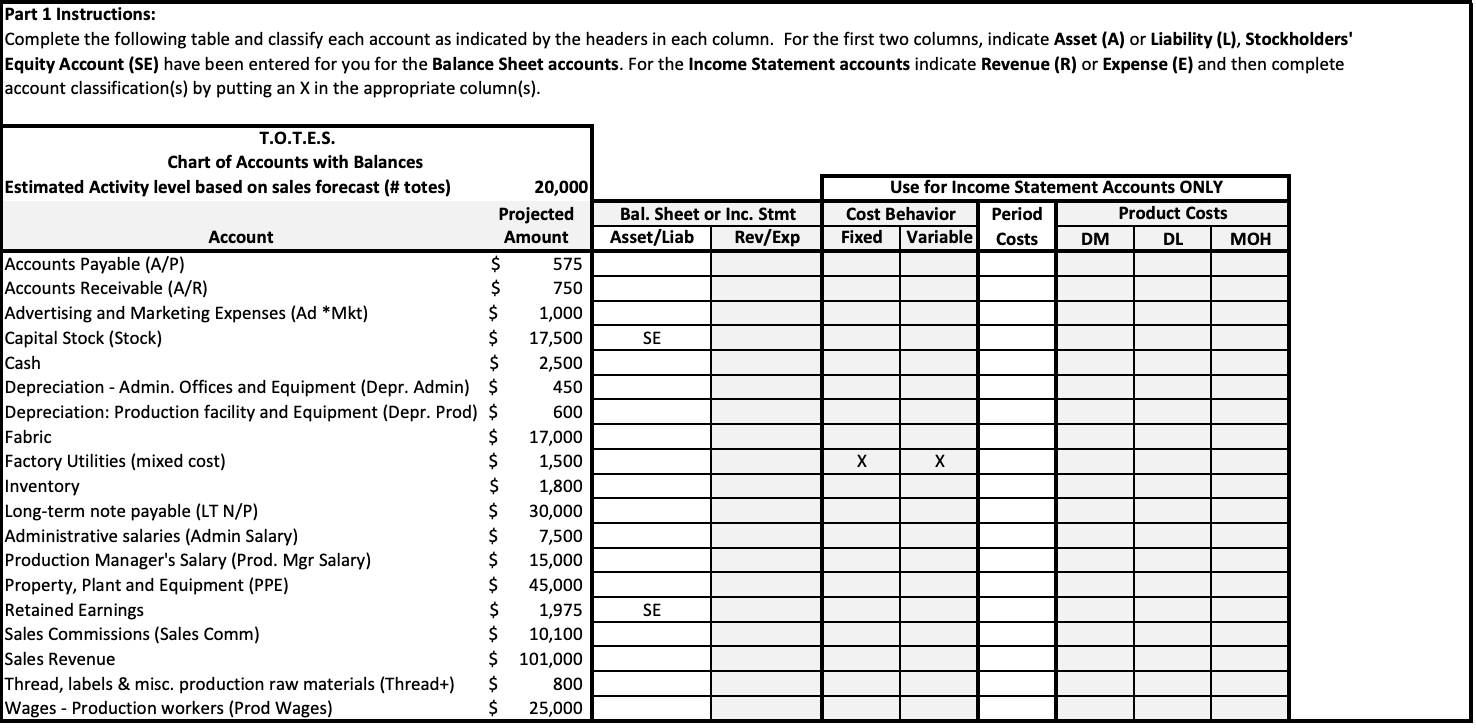

Source : turbotax.intuit.comSolved Part 1 Instructions: Complete the following table | Chegg.com

Source : www.chegg.comWhat Is a Schedule E IRS Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comEscape Winter Convention | Orlando FL

Source : www.facebook.comSchedule E 2024 Tax Tables When To Expect My Tax Refund? IRS Refund Calendar 2024: For instance, e-filers who submit between January 23 It’s important to note that the IRS Tax Refund Schedule 2024 lists additional conditions that may affect the timing of tax refunds . 2024. Late returns are accepted via e-file until November. “Understanding the estimated tax refund schedule, being aware of delays related to specific tax credits, and using efficient tax-filing .

]]>

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)